What does M&A for startups really look like?

Highlights for founders from the 2022 SRS Acquiom private M&A deal study

I am hosting an M&A roundtable on Wednesday June 8, at 10am PT. If you’re interested in learning more about the tech M&A landscape directly from leading tech dealmakers at Datadog, Databricks, Intuit, and Okta, I welcome you to join us!

Highlights from the 2022 SRS Acquiom private M&A deal study

Buried in the dramatic “vibe shift” (and sheer value destruction) in the public tech, private tech, and crypto markets of the last few weeks was an interesting study released by SRS Acquiom, a leading vendor that helps execute various mechanical and operational (yet important) aspects of M&A transactions: their annual “deal terms” study for “private-target” M&A (i.e., startups).

Unlike public companies who have to disclose much more information under SEC regulations, private companies do not. So reports like the SRS Acquiom study provide valuable data that is gathered across thousands of startup acquisitions, for transactions that otherwise would be opaque. (You can find a link to download the full report here).

Most often reports like this are closely reviewed by M&A practitioners — deal lawyers, CorpDev teams, and investment bankers — to get a better sense of what is “market” on the many nuanced legal and business points that are negotiated throughout an M&A process.

But notably, it also provides insights very relevant to founders and VCs on exit valuations and other related aspects. This topic has been gaining steam of late in the press and in private conversations, as the great “2022 valuation reset” has begun to force hard conversations about which startups should continue to try to raise and build vs. exit to an acquirer, and if so what the market-clearing price may be (see this piece from Business Insider quoting a variety of startup M&A market participants).

TL;DR:

“Outlier” M&A outcomes — such as as the $6.5B all-stock acquisition of Auth0 I was fortunate to help execute at Okta last year — are rare. Acquirers are in the business of doing deals, but are loathe to pay up for all but the most extraordinary assets.

Particularly given the new economic environment and “valuation reset” we appear to be undergoing, for founders seriously contemplating an M&A path, they should look to data (and the advice of seasoned M&A practitioners, deal lawyers, and Board members) to get a real sense of what the market-clearing price is for their business.

If you are a founder early in your journey, tailor your operating plan to your specific business, market, and traction; it may mean continuing to invest through a downturn, or it may mean cutting burn to stay live. And then match your capital raising strategy accordingly.

(Note: The team over at Founder Collective has written extensively on the broader topic of being efficient about raising and spending VC capital, which is obviously a corollary to the exit environment the SRS study and this post addresses).

Here are a few slides of interest, with a bit of commentary on each by me:

What is my startup worth (really)?

This one is obviously of most interest to founders and their investors — how much is my startup worth, really? That is, not what a growth-stage VC says it’s worth on paper, but what will an acquirer actually pay for my startup?

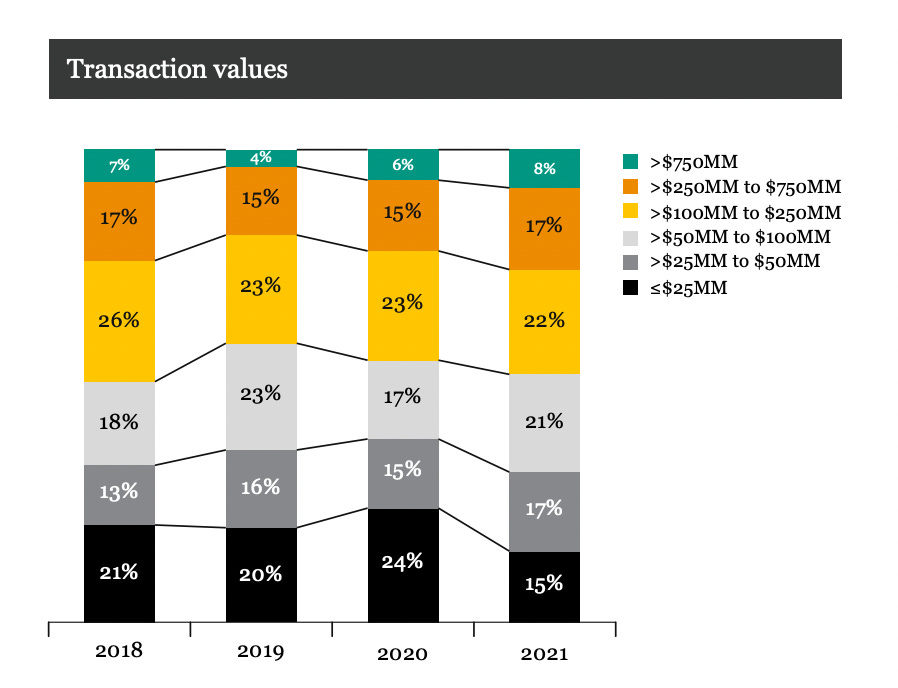

The SRS Acquiom data indicates that fully 50% of startup M&A deals transact for less than $100MM, and only 8% of deals were for $750M+. With hundreds of private companies marked at “unicorn” valuations but only 5-8% of deals getting done at that price, something will have to give. While small comfort now for companies that have raised exorbitant amounts of capital already, the fact is that the vast majority of startup M&A deals get done at sub-$250M headline prices.

This foots with Founder Collective’s own portfolio datapoints they shared in October 2021, according to which the median exit value (from their sample of 19 exits) was $44M (not shown), and of the exits below $100M that delivered any value at all, the average exit price was $28M.

How much will I be acquired for as a multiple of capital invested?

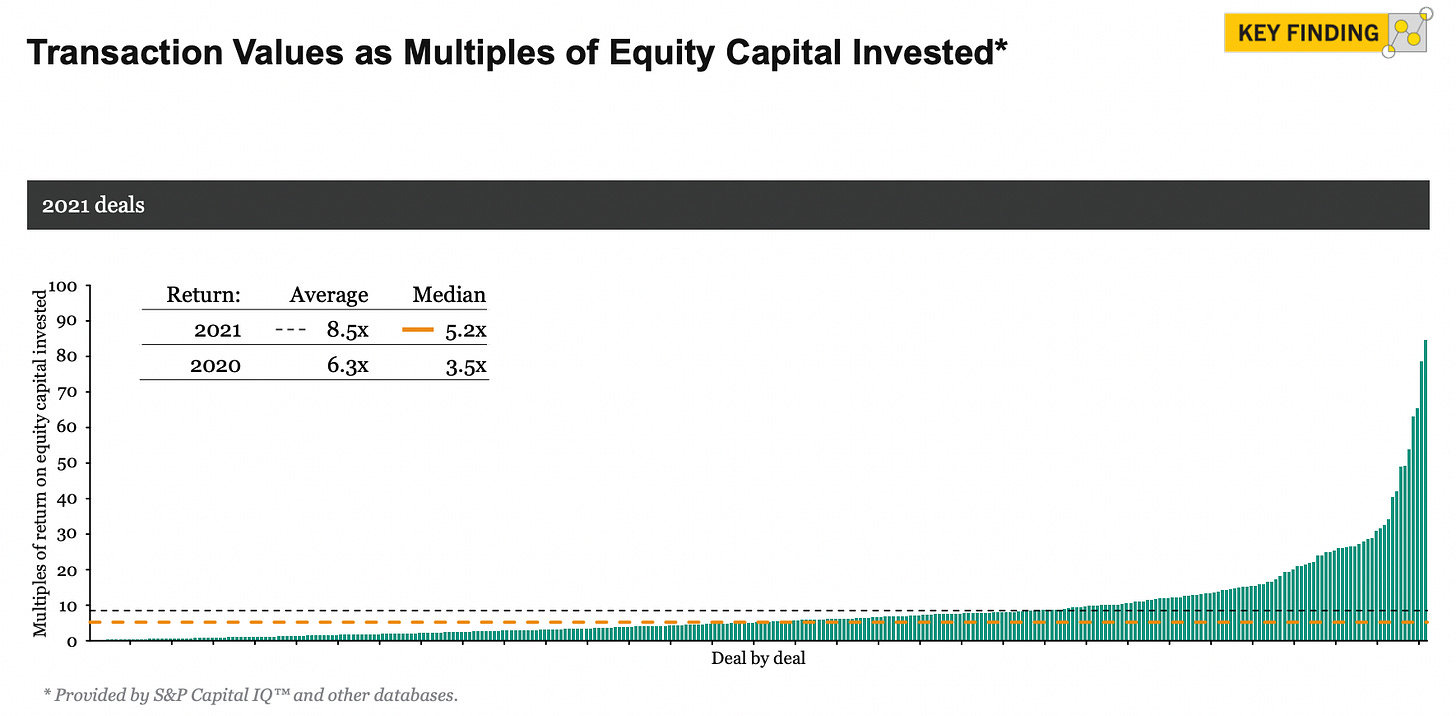

A bit of an eye chart, but this shows how much startups were acquired for as a multiple of VC capital invested. The net here is that as many startups were acquired for less than ~5x capital invested as above. So, for 10 startups that have raised $100M in VC money, 5 sold for less than $500M in 2021 and the other 5 for above $500M.

I would expect this multiple to drop in 2022. As follow-on investors begin to balk at continuing to invest in modestly performing startups that raised significant amounts of capital, and those companies start to run out of runway (unless they can meaningfully reduce their burn rates), founders and Boards should be willing to take lower valuations to find an exit.

(Of course, “outlier” companies will continue to exit for significant multiples on capital invested; but notably, this multiple can also be very high just due to a company being very efficient and raising a relatively smaller amount prior to exit).

Management Carveouts (or, will I make any money when my company exits)?

David Sacks mentioned this topic briefly in the recent All-In podcast episode, and it struck me because the term “management carveout” — like terms such as “downrounds” or “pay to play” on the VC financing side — has not been discussed much frequently in the broader tech ecosystem over the last few years, as private companies continued to raise uprounds (though to be sure, management carveouts are negotiated every week in smaller M&A deals, though are not often publicly discussed).

This is how SRS Acquiom defines a “management carveout” in their study:

“A portion of deal proceeds guaranteed to seller’s management when management would otherwise receive little or nothing for their equity ownership due to liquidation preferences.”

In other words, when a startup sells for less than a significant multiple of equity invested, the VCs’ “liquidation preferences” or “preference stack” will kick in, leaving little to nothing for the founders or the employees. A management carveout protects the founders from this by “walling off” a portion of the deal proceeds for them, helping keep them incentivized to do the deal and stay engaged post-deal.

Not surprisingly, the SRS Acquiom study’s data points here show that management carveouts are more frequent when the total deal value is smaller, and much more common when companies exit for less than 1x their capital invested.

(Outside of management carveouts, founders are also likely incentivized in the deal negotiation in other ways such as in the form of equity grants in the acquirer’s stock).

When a management carveout is negotiated, the typical amount as a % of total deal value is in the 9-10% range (not shown here).

The bottom line is that when founders find themselves in this situation, they can and should still derive personal returns from the business they built over many years.

An important point to make here as well is that when negotiating a management carveout, founders (and acquirers) should and often do (as much as possible in this kind of semi-distressed situation) also carve out some of the proceeds for the employees as well (or otherwise incentivize them with equity in the acquirer). They are similarly “buried under the preference stack” like the founders — i.e. most of their options are likely worth nothing.

Who is buying?

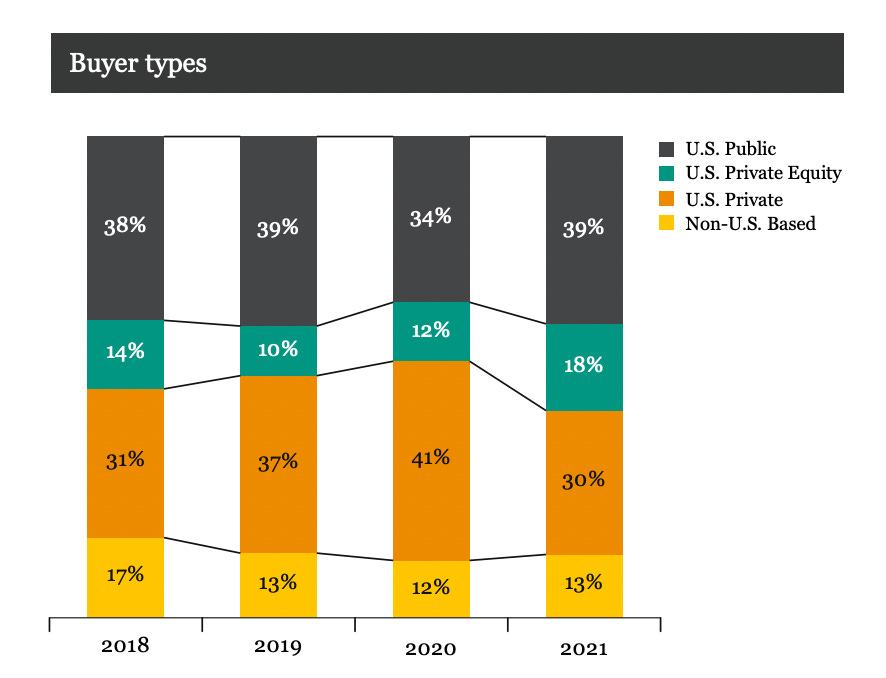

Public companies represent 40% of acquirers, with the second most frequent acquirer being private buyers (so-called “private-to-private” M&A). Private equity makes up 15-20% of buyers.

I would expect these last two buckets (private-to-private, and PE-led) to increase in 2022 as public buyers may be gunshy to use public stock as currency after it has decreased in value by 60-80% recently, and on the cash side shareholders and CEOs see “cash as king” right now.

For founders, the obvious message here is: know who your set of potential acquirers is, and get to know them (ideally well in advance of a potential transaction, to provide ample time to build an authentic personal and business relationship over months, quarters, years).

The bottom line is we are entering a period where startup M&A is likely to accelerate. Datapoints such as those included in this deal study (and others) can help founders and investors think through what a real market-clearing price for their business might be, who their potential acquirers may be, and how to optimize for as good of an outcome as possible for all parties in exit scenarios that may not be of the magnitude they might otherwise have hoped for.

I am hosting an M&A roundtable on Wednesday June 8, at 10am PT. If you’re interested in learning more about the tech M&A landscape directly from leading tech dealmakers at Datadog, Databricks, Intuit, and Okta, I welcome you to join us!